Investable Years With High-Income Levels

- 03.25.24

- Markets & Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The Federal Open Market Committee (FOMC) comprises the Federal Reserve System’s decision-makers on monetary policy in the United States. This monetary policy is designed to keep the Fed’s dual mandate of maximum employment and price stability in line with targets. The Fed has various tools or methods to accomplish its mandate including controlling the money supply and raising or lowering the Fed Funds rate as needed. The FOMC meets every 6 weeks or 8 times per year and can hold emergency meetings if deemed necessary. They met last week and announced that they would not be changing policy.

From 2022 through July 2023, the Fed raised the Fed Funds rate 11 times over a 12-meeting span for a total of 525 basis points. Since last July or over the last 5 meetings, the Fed has held rates constant at a 5.25%-5.50% target range. The bond market has been hyper-focused on the Fed and its reaction to data on inflation, employment and productivity. The market has been anticipating as many as six Fed interest rate cuts in 2024 but has pulled back expectations to three. The Fed’s loudest message has been its commitment to bringing inflation down to its 2% target level.

For the most part, it appears the market has cooperated. Economic growth has exceeded nearly everyone’s 2024 expectations and employment has remained sturdy. However, inflation has been sticky with the latest data releases reversing the downward trend and reflecting higher estimated levels. The market will keep a close eye on the next inflation release’s direction.

In general, the market has reflected a more optimistic tone with an indication that liquidity is flush and businesses and consumers are ready and willing to spend. There is a “but” however and that is at what expense? Americans have shown a propensity to spend money – disposable income or savings. When the spending relies on borrowed money, that is when destructive consequences can emerge. There is an ongoing debate as to whether consumption can drive an economy but it may be like the chicken and egg discussion. The U.S. GDP is comprised of roughly 70% of consumption expenditure by households making it almost impossible to ignore.

Last week a colleague reported high-end consumer shopping behavior has shifted and although company growth has been good, there is a noticeable pullback and shopper traffic slowdown. Perhaps more telling and alarming is the growing consumer debt levels. Consumer credit card debt has risen at an unprecedented pace. So is consumer spending, keeping economic growth numbers up but are they doing so with borrowed money?

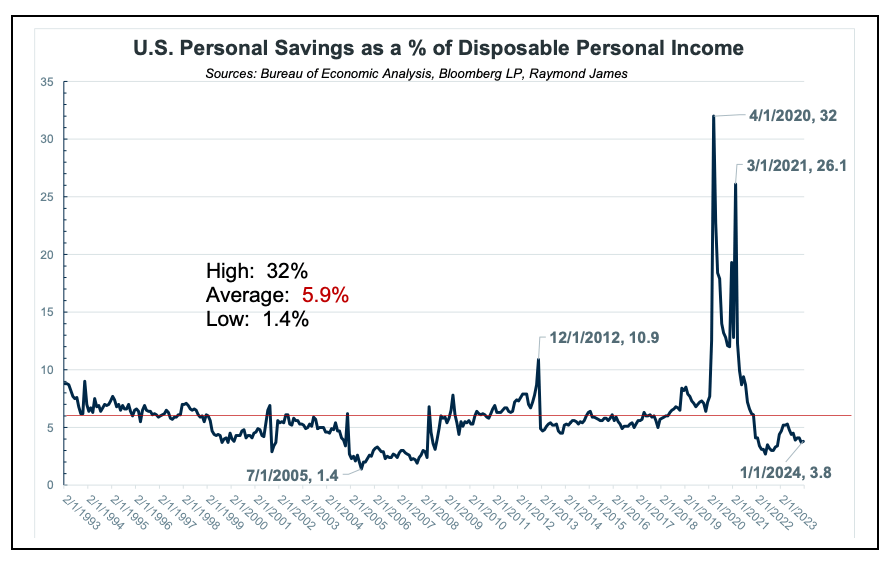

Savings peaked during COVID-19 not because consumers didn’t want to spend but because they could not. The pandemic closed businesses and services forcing consumers to sit at home. Although many jobs were lost, recall that the government stepped in putting money directly in the hands of individuals while deferring rent and loan payments. The aftereffects pushed personal savings to extreme highs. However, over the last three years, consumers not only depleted excess savings, but they lowered savings below long-term averages.

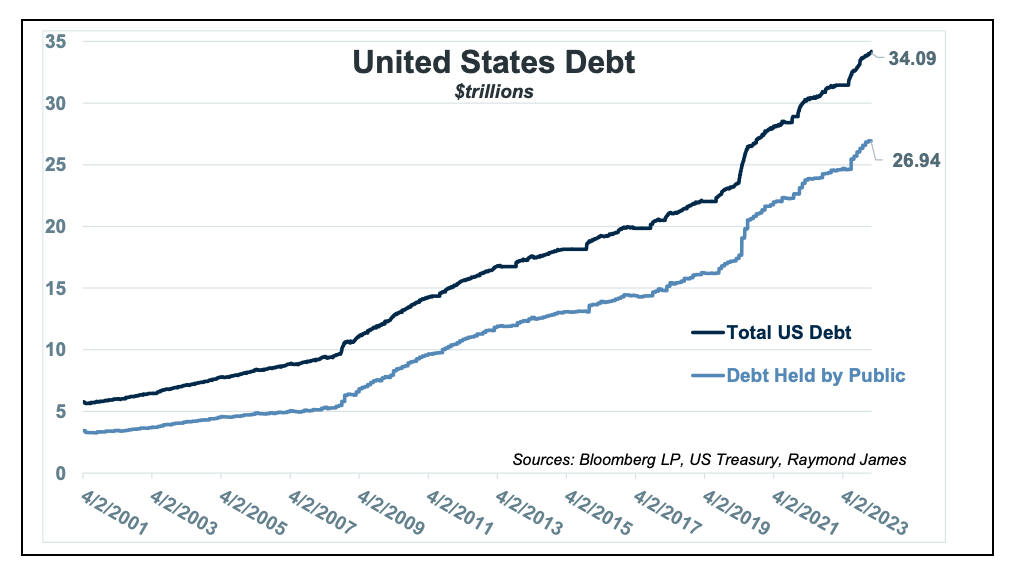

The government’s growing debt is not to be overshadowed by consumer debt. The U.S. Treasury's total debt outstanding is now north of $34 trillion.

I bring all of this to your attention for two major reasons. First, when the whole world starts to get complacent or even euphoric about the economy – it is time to be alert for the unknown or maybe even the ignored observations. Economic cycles take a long time to play out. Just because things have not played out as timely as some predicted, doesn’t mean they won’t unfold over a longer period. The Treasury curve remains inverted and history tells us that an inverted curve may be one of the best predictors of an upcoming recession. The government and consumer debt described above is not going to just vanish and consumers can spend borrowed money only for a finite time. Wages need to exceed negative inflation effects and make up for elevated debt.

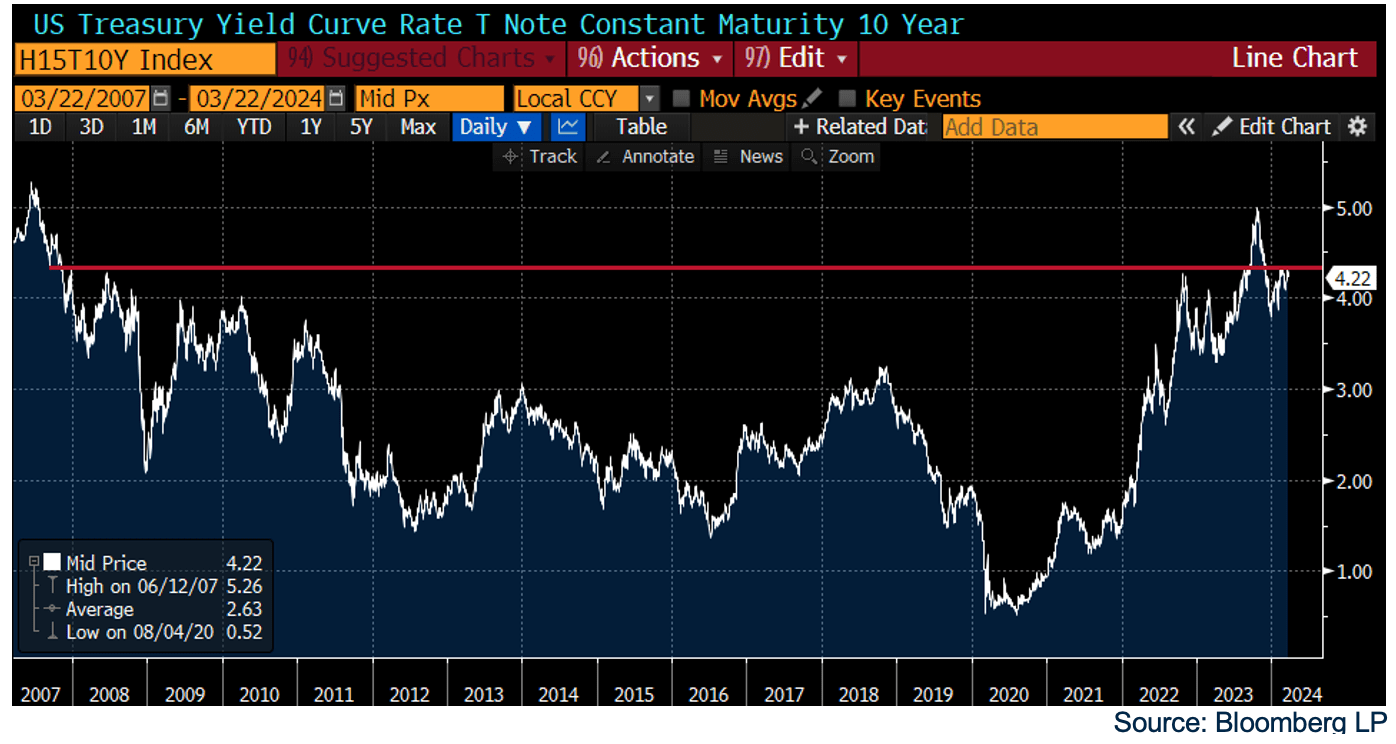

The second point is not to ignore or take for granted the known consequences of the Fed’s and the market’s actions. That is, interest rates are higher than they have been in nearly two decades. Even the most optimistic pundits believe the near-term future will bring lower interest rates. Most forecasts have reduced predictions on Fed cuts to three 25-basis point reductions this year. The market is cooperating and allowing the Fed to sit on the sidelines. There is a growing argument that they may not need to cut at all this year. In either case, the window of securing higher income levels through elevated interest rates has been extended. Most investors have a period of roughly 40 years to invest long-term savings for retirement. We’ve waited nearly half of that time for interest rates to reach current levels. Think from a long-term perspective and take advantage of this opportunity by locking in for as long as your risk tolerance will allow. The 10-year Treasury history is graphed to illustrate general interest rate levels over the last couple of decades. CDs and agency, municipal, corporate, and mortgage-backed bonds offer varying degrees of credit risk but can also offer higher rates of return. How many periods of high-interest rates can be expected during your investable years?

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.